We have decades of real-world experience with Keynesian economics. The results are not pretty.

- It didn’t work for Hoover.

- It didn’t work for Roosevelt.

- It didn’t work for Japan.

- It didn’t work for Europe.

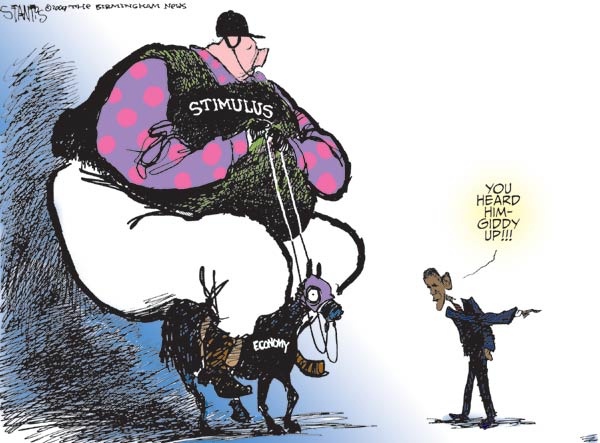

- It didn’t work for Obama.

It’s also worth pointing out that Keynesians have been consistently wrong with predicting economic damage during periods of spending restraint.

- They were wrong about growth after World War II (and would have been wrong, if they were around at the time, about growth when Harding slashed spending in the early 1920s).

- They were wrong about Thatcher in the 1980s.

- They were wrong about Reagan in the 1980s.

- They were wrong about Canada in the 1990s.

- They were wrong after the sequester in 2013.

- They were wrong about unemployment benefits in 2020.

This story needs to be told, again and again, especially since we’re now going to have another real-world test case thanks to President Biden’s so-called American Rescue Plan.

I just wrote a column on Biden’s proposal for the Foundation for Economic Education, and it is co-authored by Robert O’Quinn, who most recently served as the Chief Economist at the Department of Labor.

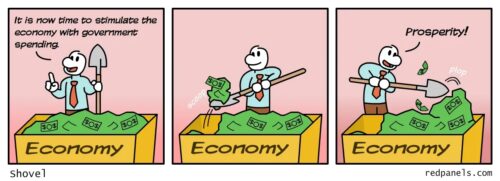

We started by pointing out that Biden is basically copying Trump’s big-spending approach, but with a different justification (Keynesianism instead of coronavirus).

Mr. Biden is bringing a new twist to the profligacy. Instead of trying to justify the new spending by saying it is needed to compensate households and businesses for government-mandated lockdowns, he is making the Keynesian argument that the new spending is a way of stimulating the economy. The same approach was used when he was Vice President, of course, but did not yield positive results. …Mr. Biden and his team apparently think the anemic results were a consequence of not spending enough money. Hence, the huge $1.9 trillion price tag for his plan. Will his approach work? …We can learn about economic recovery today by reviewing what happened during the Great Recession earlier this century and what happened at the end of World War II.

We explain the causes of the previous recession and point out that Obama’s so-called stimulus didn’t work.

…the Great Recession…was the result of an unsustainable housing bubble caused by overly accommodative monetary policy from the Federal Reserve and misguided housing policies. …it took years to clean up the mess from the bursting of the housing bubble. Households slowly rebuilt their savings and cleaned up their balance sheets. …Banks had to work out problem loans and rebuild their capital… Obama’s stimulus did not drive that healing process and spending more money would have done little to accelerate it.

And we also point out that the economy recovered very quickly after World War II, even though the Keynesians predicted disaster in the absence of a giant new package such as Truman’s 21-Point Program (his version of FDR’s horrible vision of an entitlement society).

Keynesians feared that demobilization would throw the US economy into a deep depression as federal spending was reduced. Paul Samuelson even wrote in 1943 that a failure to come up with alternative forms of government spending would lead to “the greatest period of unemployment and industrial dislocation which any economy has ever faced.” …President Harry Truman proposed “a 21-Point Program for the Reconversion Period” shortly after the war ended. But his plan, which was basically a reprise of Franklin Roosevelt’s New Deal, was largely ignored by Congress. Did the economy collapse, as the Keynesians feared? Hardly. …Spared a repeat of FDR’s interventionism, the economy enjoyed strong growth. One of the big tailwinds for growth is that the forced savings accumulated during the war years allowed consumers to go on a peacetime buying binge.

That last sentence in the above excerpt is key because 2021 is a lot like 1945. Back then, households had lots of money in the bank (wartime rationing and controls meant there wasn’t much to buy), which helped trigger the post-war boom.

Something similar is about to happen, as we explain in the column.

The current economic conditions are somewhat reminiscent of the ones that existed after World War II. The limited ability to spend money during the pandemic has helped boost the personal saving rate… In aggregate terms, personal saving soared from $1.2 trillion in 2019 to $2.9 trillion in 2020. …pent-up demand funded with more than $1 trillion in excess savings will resuscitate…GDP.

So what does all this mean? Well, the good news is that 2021 is going to be a very good year for the economy. That’s already baked into the cake.

The bad news is that Biden is taking advantage of the current political situation to increase the burden of government spending.

…the economy prospered after World War II despite (or perhaps because of) the failure of Mr. Truman’s 21-point proposal. President Biden’s team is either unaware of this history, or they simply do not care. Perhaps they simply want to take advantage of the current environment to reward key constituencies. Or they may be trying to resuscitate the tattered reputation of Keynesian economics by spending a bunch of money so they can take credit for an economic recovery that is already destined to happen.

Since I gave the good news and bad news, I’ll close with the worse news.

There’s every reason to expect very strong growth in 2021, but Biden’s spending binge means that future growth won’t be as robust

- Especially since the economy also is saddled with lots of wasteful spending by Bush, Obama, and Trump.

- And especially if Biden is able to push through his agenda of higher taxes on work, saving, and investment.

The bottom line is that the United States is becoming more like Europe and the economic data tells us that means less prosperity and lower living standards.